It's bonus season! How Americans plan to spend (or save) their bonus

Cha-ching – It’s bonus season! Here’s how much Americans expect to receive, and if they plan to spend or splurge the extra cash

Cha-ching – It’s bonus season! Here’s how much Americans expect to receive, and if they plan to spend or splurge the extra cash

Key takeaways

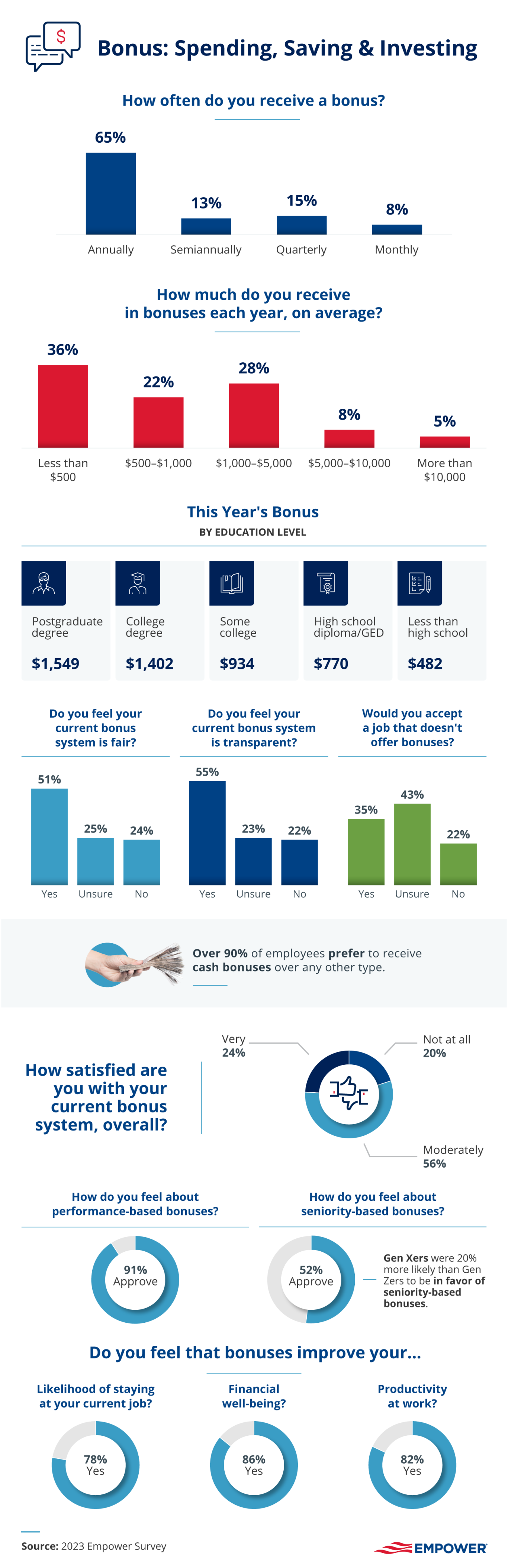

- More than 8 in 10 employees feel bonuses improve productivity at work.1

- Nearly 60% of American employees plan to use their bonus for savings.

- Financial professionals recommend using bonuses to invest in a 401(k), pay off debt or contribute to an emergency fund.

- More than 40% Americans plan to spend their bonus on travel.

The most wonderful time of the year?

Many working Americans receive a bonus at least once a year — but what do most of them do with the extra cash? We recently asked 900 Americans from different generations how they typically spend their bonuses. We then gathered advice from 100 finance professionals on how employees can use their bonuses to improve their financial well-being. Read on to discover the insights that both groups had to offer and how they compare.

Perks of the job

Over 80% of employees surveyed reported that bonuses increased their overall financial wellness and motivated them to be more productive at work. Handing out bonuses also boosted retention, as 78% of employees reported that the possibility of a bonus increased their odds of staying with their current employer.

Even a little bit goes a long way – the most common bonus payout among respondents (36%) was less than $500. Nearly a quarter (28%) expected a bonus in the range of $1,000-$5,000, with a lucky few (5%) expecting a bonus more than $10,000.

Making Your Bonus Work for You

Alongside the excitement of receiving a bonus comes the question of how best to spend it.

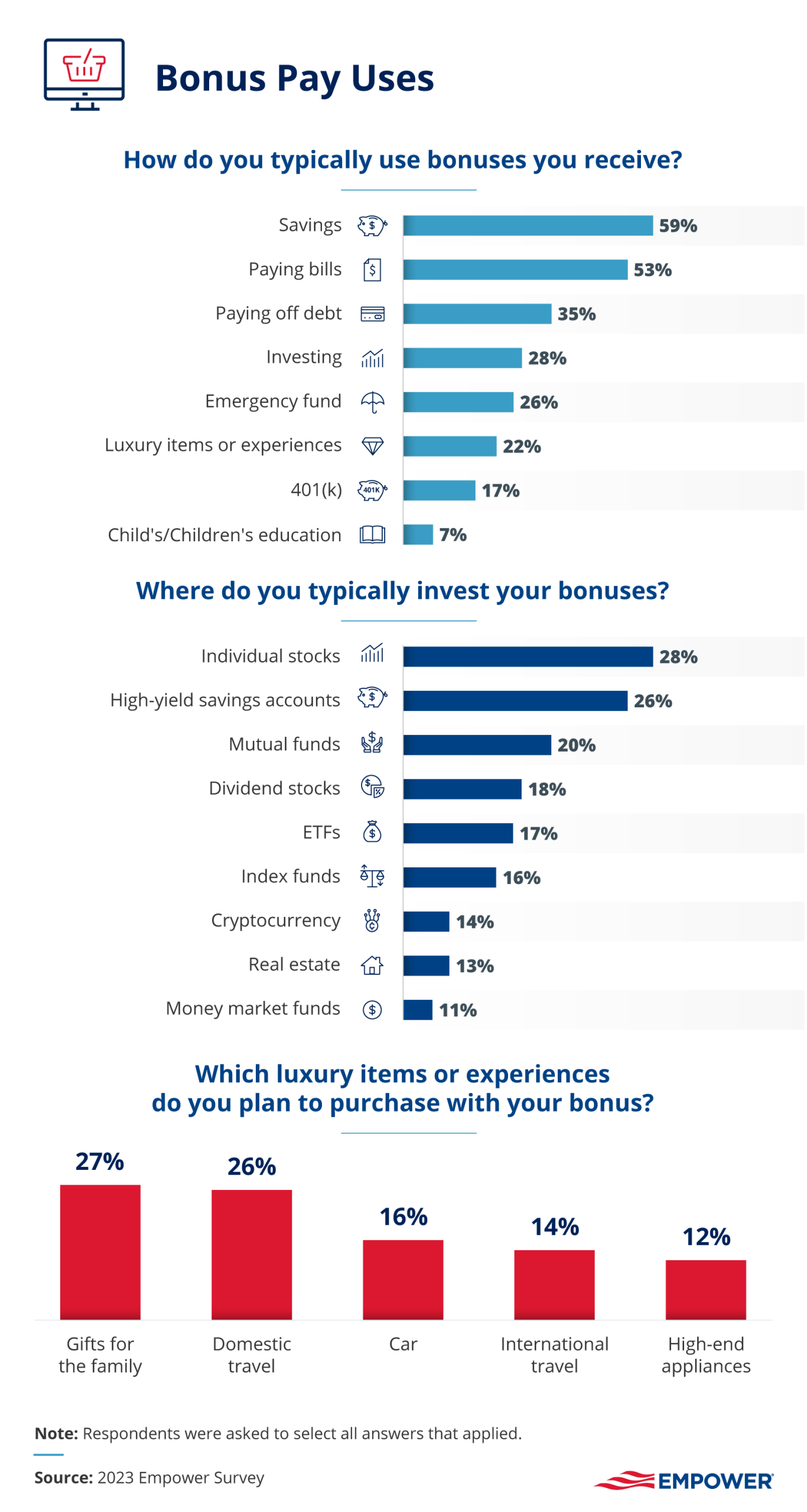

As it turns out, nearly 60% of Americans have stashed their bonuses away in savings, with only 22% preferring to spend the extra money on a luxury purchase or experience. Of those who chose to spend, 27% shared the wealth by purchasing a gift for family, another 40% chose to take a vacation. If they weren’t jetting away, respondents were upgrading their home: 12% said they would be spending their bonus on high-end appliances.

For those who going to use their bonus for investments, their top three choices were:

- Individual stocks (28%)

- High-yield savings accounts (26%)

- Mutual funds (20%)

Different generations had their own investing preferences:

- 22% of baby boomers declared themselves fans of the high-yield savings account.

- 23% of Gen Xers were more likely to invest in mutual funds.

- Millennials (34%) and Gen Zers (24%) preferred to purchase individual stocks.

The Professionals Weigh In

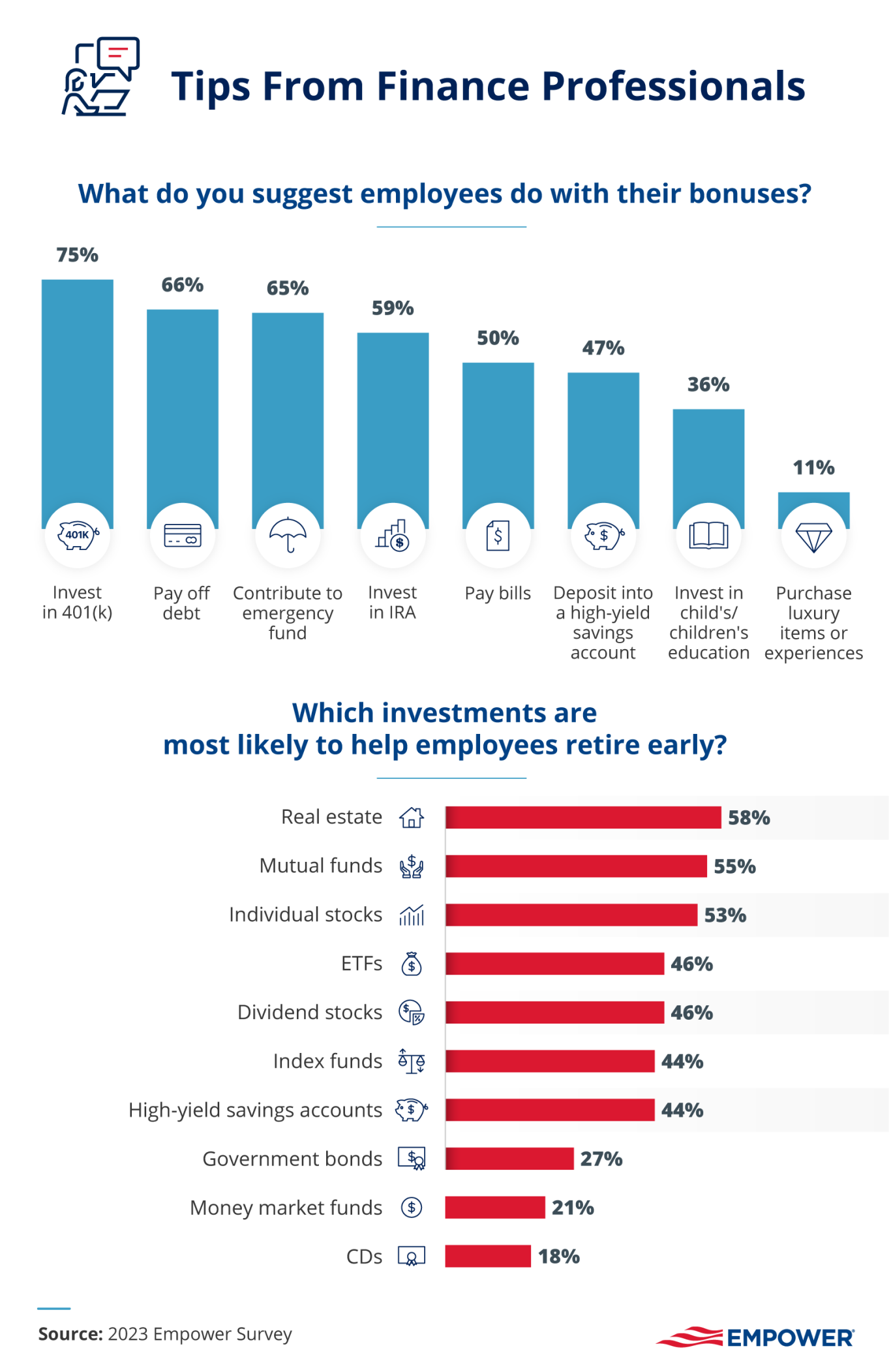

When it comes to the smartest ways to use your bonus, the financial professionals we surveyed most often suggested:

- Investing in a 401(k)

- Paying off debt

- Building an emergency fund

It’s important to remember to evaluate this advice in terms of your personal situation.

Historically, the stock market (as measured by the S&P 500) has offered an average return of just over 10%.2 So, unless you owe high-interest debt (for example, if you’re paying on a credit card with a 28% APR), you may want to consider investing your bonus instead. If you’re planning to make a large purchase soon (like a car or home), then it’s also worth weighing how much a larger down payment could lower your interest rate. The financial pros surveyed recommend putting your bonus toward a mix of real estate, mutual funds and individual stocks if your main goal is early retirement.

As bonus season approaches, consider different ways to put your money to work based on your individual goals and circumstances. If you’re expecting a bonus soon, it may be worth talking to a financial professional to help clarify the best options for your situation.

1Methodology

Empower contracted Fractl to survey 900 Americans regarding their bonus plans. The mean age of respondents was 41 years old. Among them, 47% were male, 52% were female and 1% were nonbinary. Respondents comprised the following generational breakdown: 13% Gen Z, 53% millennials, 28% Gen X and 13% baby boomers.<

Additionally, 100 financial professionals were surveyed regarding their perspectives on employee bonus plans. The mean age of respondents was 37 years old. Among them, 51% were male, and 49% were female. Respondents comprised the following generational breakdown: 9% Gen Z, 59% millennials, 28% Gen X and 4% baby boomers. The financial professionals who participated in this survey were selected based on several criteria. First, we identified potential participants who work in the financial industry and have relevant experience and expertise in the subject matter of the survey. Second, we screened potential participants to ensure that they met specific qualifications, such as having a certain level of education.

Fair Use Statement

If you know anyone who would benefit from these findings, feel free to share! We ask that you share our content for non-commercial purposes only and provide a link to this page for reference.

2Seeking Alpha, What Is The Average Return Of The Stock Market, January 2, 2023.

The S&P 500 Index is a registered trademark of Standard & Poor’s Financial Services LLC. It is an unmanaged index considered indicative of the domestic large-cap equity market and is used as a proxy for the stock market in general.