Financial planning for young adults

Financial planning for young adults

Financial planning for young adults

Fresh out of college, many recent graduates are entering the world of full-time work for the first time.

I frequently talk with clients about financial planning and investing for their college-aged kids. Many of these parents wish they’d started sooner – and I applaud them for talking about smart money management with their kids. They’re helping pave the way for a more financially prepared generation: More than half of American adults never talked about finances growing up, according to our recent Money Talks research.

Here are my top seven suggestions for young people looking to get started with investing and planning their financial future.

1. Get comfortable budgeting

You may have worked on a part-time basis during college, like 45% of undergraduate students.1 Earning a real-world paycheck for the first time is exciting, and it can be tempting to spend it on what you want in this phase in life.

I’d encourage you to take a step back and look at what you really want out of life. Would you eventually like to buy a house? Afford a newer car? Retire someday? Then you’ll want to start saving.

One common and useful approach to budgeting is the 50-30-20 rule that divides your income into three main categories:

- 50% for needs: These are your basic living expenses, like housing, utilities, food, clothing, insurance, and transportation.

- 30% for wants: This is the discretionary spending on things and experiences that help make life fun, such as entertainment, eating out, vacations, recreation and hobbies, and non-essential items.

- 20% for savings: This covers savings to meet both your short-term and long-term goals. It may also include debt repayment for expenses like student loan payments.

Budgeting involves tradeoffs.

For instance, if you live in a more expensive city, you may need to compromise by spending less money on entertainment. This is a tough proposition – a top reason for moving to urban centers is enjoying what the city has to offer outside of the home or office. So look into alternative options for fun. Go to free museum days. Picnic at your local park. Invite your friends over for dinner at your place.

Learning how to budget early on is a foundational tool as you earn more money (and are able to spend more money). Also, budgeting allows you to enjoy spending your money guilt-free because you plan for the fun stuff, too. Otherwise, why are you working so hard?

2. Build up your rainy day fund

Emergencies happen. As a baseline, work toward setting up an emergency fund that covers 3-6 months of basic living expenses. This bank account is often separate from your checking account used for daily expenses. That’s because you don’t touch it unless you need it, like if your car requires repairs, you have to visit a specialist that your insurance doesn’t cover, or you get laid off and need a cushion for your time on the job hunt. To get the most bang for your buck, you can set up a high-yield cash account, which gives you cash returns for stowing your money with that bank.

Another valuable savings tool is a sinking fund, a pool of money that you intend to spend on a particular need or want at some point in the future. These expenses happen only occasionally or sometimes just once. Think of that vacation that you’ve just started daydreaming about or the holidays coming up. These aren’t monthly expenses that you’re used to budgeting for and they aren’t emergencies. They’re occasional expenses, and if you plan for them, you won’t go over budget when they occur.

3. Be mindful of your debt-to-income ratio

For most adults, debt is part of life. The average American holds a debt balance of $96,371. That’s up 3.9% from the previous year’s average balance of $92,727, largely due to the rising balance of mortgage and auto loans.2 Adults with that level of debt likely make significantly more money than a person just starting out their career.

As you start earning and spending, it’s important to be aware of your debt-to-income ratio, which is all your monthly debt payments divided by your gross monthly income. Throughout life, you want to maintain a debt-to-income ratio of no more than 35%.

Student loan debt

The most common debt for people just out of college? Student loans. New research from Empower indicates that 1 in 3 households with student debt expect their federal loan payments to total at least $1,000 each month when payments resume in October.

Carve out a space in your monthly budget dedicated to your loan payments. Doing so gets you in the habit of planning to make each payment, putting you on track to pay down all the debt.

Student loans can be viewed as “good” debt because they are an investment in your future – one that pays off as you progress in your career.

Consumer debt

In our recent survey, 50% of Americans told us their most valuable financial lesson has been avoiding excessive debt. Credit card debt is often viewed as “bad” debt because, unlike student loans, it doesn’t pay dividends in the future. And due to compounding interest, not making your monthly payments can make it challenging to pay off completely.

However, credit cards can be a helpful tool in building a solid financial foundation. Using credit responsibly helps build your credit score, which enables you to secure big-ticket loans like a mortgage. But there are a few ground rules:

- Spend only what you can afford

- Pay off your balance in full and on time at the end of each monthly billing period

- Align your financial values with credit card perks, like airline miles or cashback points, so that you get a benefit from responsible spending

4. Keep your biggest expenses in check

One of the things that you may be looking forward to is having your own place.

A general rule of thumb for living expenses is to keep your rent (or mortgage) under 30% of your annual salary. One way to calculate a good monthly expense target is to take your after-tax salary and divide it by 40.

Higher taxes and rent prices make it tougher to live in the most attractive neighborhoods without having a really well-paying job. If you make $60,000 a year after tax, then you’ll probably have to settle for roommates in places like San Francisco and New York City.

But it’s not all bad; having roommates in your 20s can be a great way to build community. You can cook together, host movie nights, and share household expenses and responsibilities.

5. Invest early and often

From my perspective, investing for retirement is like a bill — it needs to get paid every month. But for young investors, one of the biggest mental hurdles in long-term investing is that retirement can feel so long away. With conflicting financial priorities, why should investing be a priority?

Investing early and consistently can hugely pay off in the long run, thanks to the potential of compounding returns. This means that in your diversified portfolio, your money goes to work for you by potentially earning more money. When searching for funds to invest in, consider looking for funds that provide broad market exposure.

For recent college grads, your investment time horizon is very long – somewhere between 40 and 50 working years if you plan to work until traditional retirement age. (Though the Gen Zers we spoke with recently told us they want to be financially free by age 43.) Given your long timeline to retirement, your risk tolerance may likely be aggressive, meaning primarily equity-driven with some fixed-income exposure for diversification.

Of course, every individual’s risk tolerance is different. Consider talking with a financial professional to determine the right investment strategy for your goals.

If you follow the 50-30-20 rule, you can shoot for setting aside 20% of your income. If it feels like a lot, remember how much it can pay off in the long run.

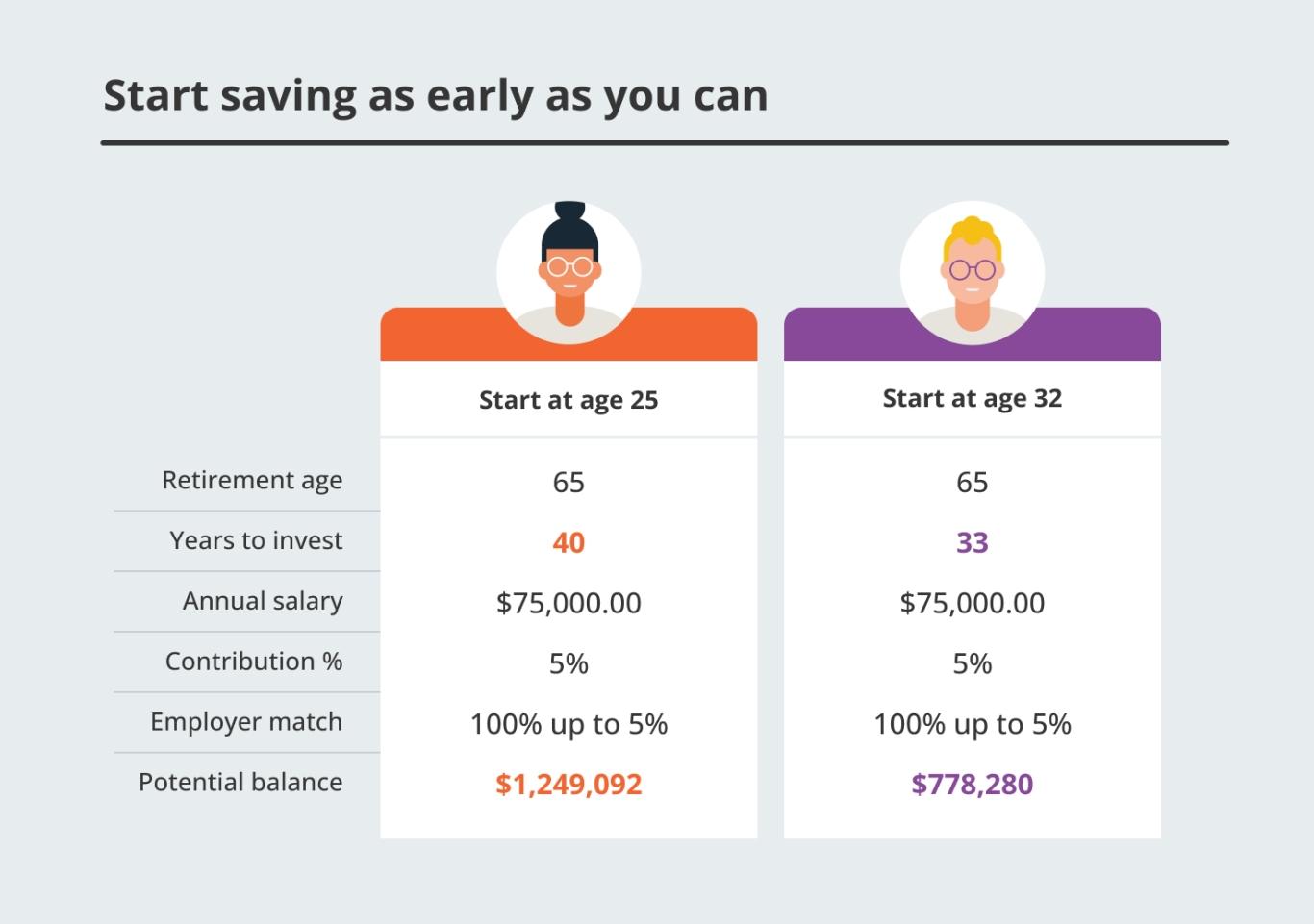

FOR ILLUSTRATIVE PURPOSES ONLY. This is a hypothetical illustration to show the value of saving early; it is not intended as a projection or prediction of future investment results, nor is it intended as financial planning or investment advice. It assumes a 6% average annual rate of return, $75,000 starting salary with no increases invested over 40 years and 33 years. Rates of return may vary. This illustration does not include any charges, expenses or fees that may be associated with your program. Fees could change the outcomes provided.

To help keep you on track, automate your investment contributions. This way, you don’t see the money exit your account. It may hurt a bit, but keeping tabs on your investment growth can help fuel the momentum.

6. Ask about your employer’s 401(k), and consider a Roth IRA

If you’re starting out a new career, check into your employer sponsored 401(k). This tax-advantaged account can help you maximize your savings early on.

Questions to ask:

- Is there a Roth option? (Roth versus traditional may be a better option. This means you pay taxes on your contributions now instead of when you’re in retirement. It may suit you for the time being since you’re just starting out your career and are likely in a lower tax bracket.)

- What’s your match? (Consider contributing at least up to your employer match. These are funds you employer adds to your retirement plan. It’s part of your total compensation; don’t leave money on the table.)

Additionally, a Roth IRA may be a good option for you if you don’t exceed the income limits. Here are some benefits of this retirement plan:

- You contribute with after-tax dollars, which means you’ve already paid taxes on the money you contribute

- Roth IRAs don't have required minimum distributions, which provides a bit more flexibility when it comes to managing your retirement savings

- You can withdraw your contributions at any time without a penalty because you’ve already paid taxes on the contribution amount

Again, automate these contributions so that you can stay focused on spending within the limits you’ve set for yourself.

The bottom line

Saving for your goals and spending within your means are practices that will help set you up for a lifetime of success as you earn more money and step into a more complex financial situation.

Along the way, there are resources to help keep you on track. The Empower Personal DashboardTM – which is free and simple to set up – is used by millions of adults to get a clear picture of their financial lives. You can use it to:

- Track and categorize your spending, and set up a budget

- Create plans for debt payoff and long-term goals like retirement

- Analyze your investment performance and check up on fees

Last thing: Pat yourself on the back. You’re making smart money moves and putting yourself in the driver’s seat of your financial life. Buckle up; it’s going to be a great ride.

Asset allocation, diversification, and/or rebalancing do not ensure a profit or protect against loss.

1 American Association of University Professors, “Recognizing the Reality of Working College Students,” February 2020.

2 Bankrate, “Average American debt statistics,” January 2023.

RO3032655-0723

The content contained in this blog post is intended for general informational purposes only and is not meant to constitute legal, tax, accounting or investment advice. You should consult a qualified legal or tax professional regarding your specific situation. No part of this blog, nor the links contained therein is a solicitation or offer to sell securities. Compensation for freelance contributions not to exceed $1,250. Third-party data is obtained from sources believed to be reliable; however, Empower cannot guarantee the accuracy, timeliness, completeness or fitness of this data for any particular purpose. Third-party links are provided solely as a convenience and do not imply an affiliation, endorsement or approval by Empower of the contents on such third-party websites.

Certain sections of this blog may contain forward-looking statements that are based on our reasonable expectations, estimates, projections and assumptions. Past performance is not a guarantee of future return, nor is it indicative of future performance. Investing involves risk. The value of your investment will fluctuate and you may lose money.

Certified Financial Planner Board of Standards Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, CFP® (with plaque design), and CFP® (with flame design) in the U.S., which it authorizes use of by individuals who successfully complete CFP Board's initial and ongoing certification requirements.

Advisory services are provided for a fee by Empower Advisory Group, LLC (“EAG”). EAG is a registered investment adviser with the Securities and Exchange Commission (“SEC”) and subsidiary of Empower Annuity Insurance Company of America. Registration does not imply a certain level of skill or training.