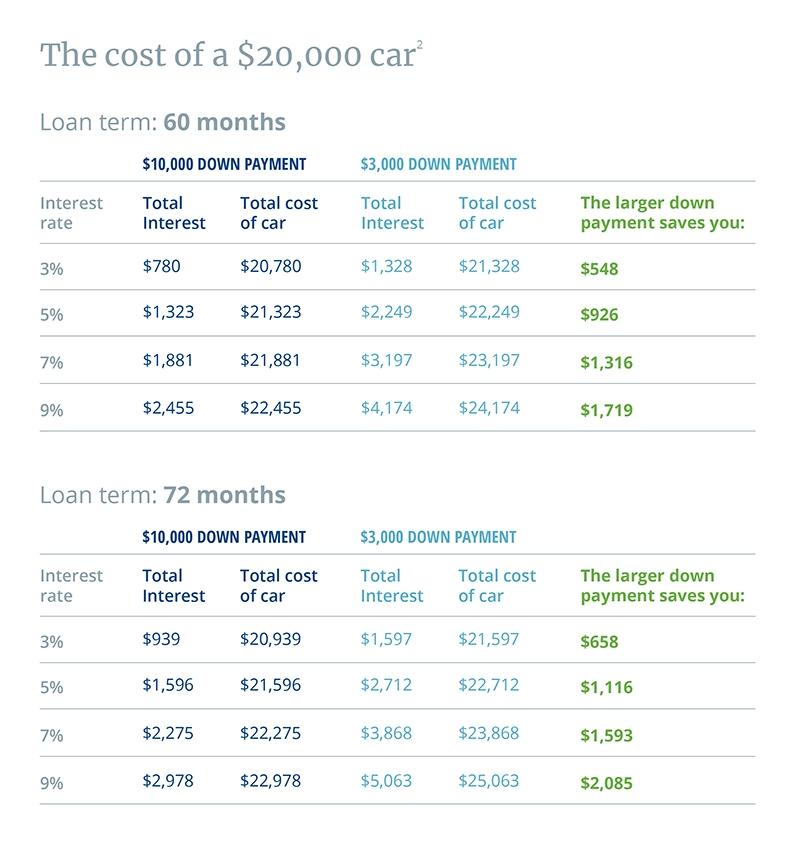

The advantage of paying cash for a car

The more you can pay up front, the less you’ll spend on interest

Borrowing to buy a car or truck is more popular than ever. In the past eight years, the total auto debt in the United States rose from $710 billion to $1.27 trillion, and the most common term for an auto loans is now 72 months.1

Consider bucking those trends by saving cash for a down payment. Putting down more may help you take on less debt and pay it off faster — potentially saving you big money in interest. What’s more, making a bigger down payment may even qualify you for a lower-interest rate.

The charts below show how much interest you’ll pay over time if you buy a $20,000 car and put down either 50% ($10,000) or 15% ($3,000), based on various interest rates.

FOR ILLUSTRATIVE PURPOSES ONLY

Save for your next car purchase with an Empower Investment Account

1 wallethub.com/edu/auto-financing-report/10131/, August 2019

2 bankrate.com/calculators/auto/auto-loan-calculator.aspx, as of February 2020